This FREE webinar is provided, by Romulus. Special to WorldTribune, July 17, 2023

This FREE webinar is provided, by Romulus. Special to WorldTribune, July 17, 2023

MARKET Watch

by RomulusEarnings season is off and running! Since we have a free webinar for WorldTribune.com readers coming up, I'd like to introduce some of the kinds of trades we do.

On July 1st, we hosted a special session on what we call the Fade Trade. A fade trade takes advantage of the weakness of a seemingly strong stock that gaps up when it is already over-extended. Earnings season is a great time to hunt for these types of trades, and Friday was a perfect example. For the last two weeks in Club Romulus we’ve been discussing the potential of JPM setting up for a Fade Trade, and it didn’t disappoint. The stock gapped up Friday morning after running up several days in a row, then proceeded to sell off the rest of the day.

According to the posts and messages I’ve received, a lot of our members took a nice profit on that fade.

Grow Wealth, Not Risk. Trade alongside a 29-year market veteran

JPM wasn’t the only bank to slide on Friday. Wells Fargo fell a little, and Citigroup fell a lot. It is possible that the rest of the reporting season could go like this, with some of the big tech names moving up while others drop. There is certainly bullish bias in the market for big tech, which means selling could provide buying opportunities. However, buying the tech sector way up high right before earnings is gambling. We will be posting any potential Fade Trade setups for members in our social media channel.Free Webinar: Victory Unit Masterclass—Manage your own portfolio like a pro!

A word about Verizon (VZ). The stock has been falling all year, with another new low on Friday. Short term, we started a small long position, meaning VZ is close to at least a temporary bounce.

For retirement accounts and longer-term money, however, VZ could be offering something different. At the current price, the company is now paying almost 8% a year in dividends, the highest of all the Dow 30 stocks and one of the highest in the S&P 500. There is little probability that VZ will cut that payout anytime soon.

In addition, VZ has weekly stock option expirations. For every 100 shares owned, investors can sell calls on the stock (selling the next closest expiration). Shareholders should expect to received at least 6% a year in collected call premiums. For readers familiar with selling call options, this is a potential opportunity. For those who aren't this is something that I teach and with a reasonable time investment you can learn.

Club Romulus: Where knowledge plus action equals profit

For example, I have owned RKT for 11 months and I sell covered calls every week. I only receive $2 or $3 a week per call option (per 100 shares owned), but this has added up. I am currently up 45% in RKT.

For VX, combining the dividend with selling calls for Verizon brings the annual return to almost 14%. Because VZ has been in a downtrend for a while, it is quite possible that the stock can continue lower over the intermediate term. Over the next few years, however, it is also probable that VZ can muster at least a small average gain on the stock price itself.

At $34 a share, there is a good chance that VZ can provide an 18% annual return for the next three years, using this method.

Speaking of RKT, one of the reasons the stock has done well lately is due to the extremely high short position in the stock—specifically, these shorts have been getting "squeezed" (forced to buy), as the price rises, benefiting long positions. RKT is one of the most heavily shorted stocks in the country.

RKT is a sideways bouncing stock that has paid +45% over the last 11 months.

RKT is a sideways bouncing stock that has paid +45% over the last 11 months.Electric vehicle companies are also heavily shorted these days, and a few of could be nearing an interesting point. Fisker Automotive and Lucid are EV makers that have been struggling lately. The stocks are down over the last few days, but it will take a much larger selloff before a low-risk long entry arrives. They are heavily shorted for a reason—they are high-risk ventures. We will continue discussing these in member areas over the next few weeks.

Remember:

Wealth, like Rome, cannot be built in a day. But, like Rome, it can be lost in a day. To learn about and sign up for Romulus' free webinar, click on the sidebar ad, or go here: Victory Unit MasterclassWatch for future announcements from Romulus about profitable market moves, important indicators, and major market swings. For trading education, mentoring, or to beat the markets with Romulus’ trading group, contact romulusteaches@yahoo.com.

About the author: In his real-life existence, Romulus started on Wall Street in 1994 and traded for a hedge fund for 13 years. Since 1994, he has called every major market top ahead of time and profited from them, including the break of the Dot-com bubble in 2000, the market crashes of 2008 and 2009, and the Covid crash of 2020. Since 2020 he has been working with investors and traders to actively manage their portfolios by growing wealth, not risk, as a teacher and mentor.

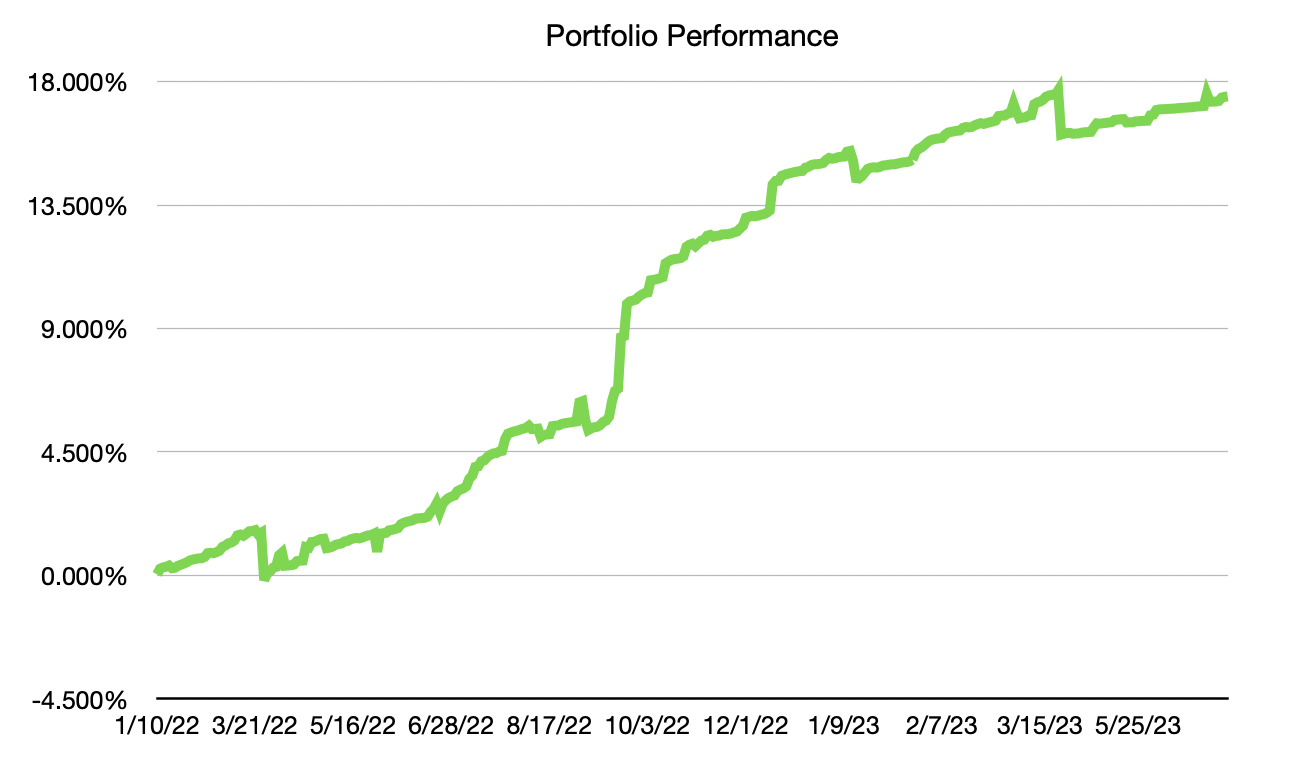

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%. The following graph approximates the potential growth of the Endowment for Press Freedom.

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%