Since Joe Biden was installed in the White House, the average monthly mortgage payment has nearly doubled, a report said.

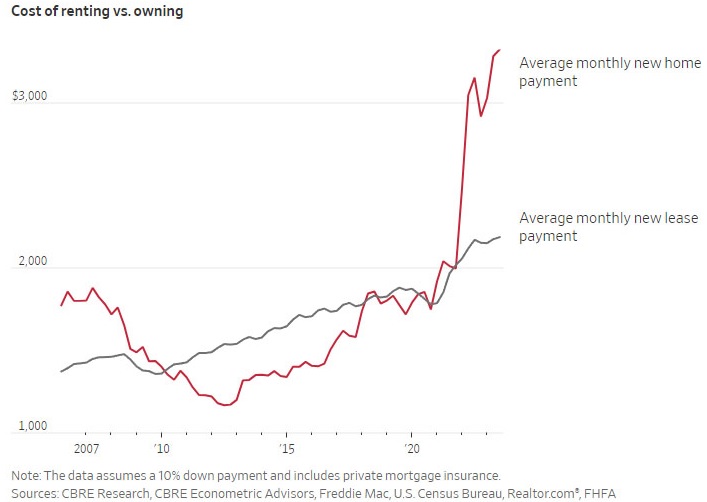

Americans on average are shelling out $3,322 per month for a mortgage, according to a Dec. 11 analysis by the Wall Street Journal.

When President Donald Trump left office, the average monthly mortgage payment was $1,787.

For millions of Americans, including those who prior to the Biden administration could afford it, "home ownership has become a pipe dream," the analysis said.

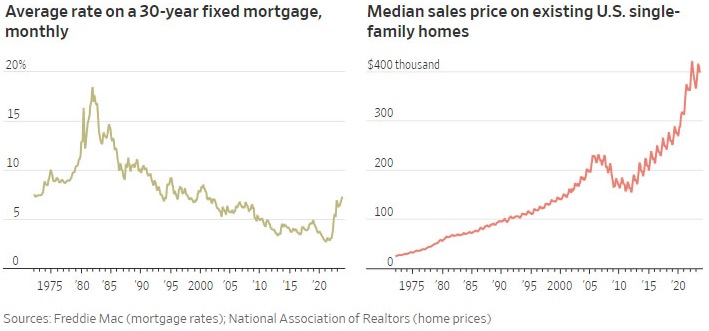

“Many would-be buyers were already feeling stretched thin by home prices that shot quickly higher in the pandemic, but at least mortgage rates were low,” the report adds. “Now that they are high, many people are just giving up.”

Breitbart's John Nolte reminds us who is looking to enter the housing market — "young people. And who do young people vote for overwhelmingly? Democrats. And so, allow me to welcome you to today’s edition of People Getting What They Vote For:"

From the Journal's analysis: "It is now less affordable than any time in recent history to buy a home, and the math isn’t changing any time soon. Home prices aren’t expected to go back to prepandemic levels. The Federal Reserve, which started raising rates aggressively early last year to curb inflation, hasn’t shown much interest in cutting them. Mortgage rates slipped to about 7% last week, the lowest in several months, but they are still more than double what they were two years ago."

Before the Biden Fed "started raising rates, a person with a monthly housing budget of $2,000 could have bought a home valued at more than $400,000. Today, that same buyer would need to find a home valued at $295,000 or less," the Journal's analysis said.

About one-third of buyers this year were first-time home buyers, below the historical average of 38%, according to the National Association of Realtors. The median first-time buyer was age 35. That was the second-highest on record, behind only 2022’s peak of 36.

Skyrocketing mortgage payments are "not only due to the Bidenflation caused by His Fraudulency’s lunatic government spending. There are other factors…," Nolte wrote.

Nolte continued:

"For those of you who vote Democrat and are currently pissing away all your money on rent because you can’t afford a home, riddle me this: What happens to the housing market when a president throws open our southern border to millions and millions of illegal aliens who need a place to live? Think hard now… Could it be that when you have a finite amount of something people want and then flood the country with millions more people who want it…? Yes, that’s right, dummies, the cost of that Something People Want explodes and that Something People Want becomes scarcer. And now you want it and can’t get it because you’re a dummy.

"The second factor is this… Democrats hate single-family homes. This is why they use Climate Change to justify blocking the construction of new homes. Democrats want us all packed in cities in massive government housing complexes. By the way, they make no secret of this.

"The final factor is this… This is all by design, dummies. Democrats know lunatic government spending creates lunatic inflation and that lunatic inflation destroys purchasing power and creates high interest rates that make it impossible for the middle class to purchase a home. Democrats also know that when you flood a country already dealing with a housing crisis caused by enviro-lies with millions of illegals, housing costs explode.

"Democrats don’t want you to own anything, especially a house."

Publishers and Citizen Journalists: Start your Engines