This FREE webinar is provided, by Romulus.

This FREE webinar is provided, by Romulus.

Special to WorldTribune, July 16, 2023

MARKET Watch

by R. Clinton Ohlers WorldTribune's Investigative Editor Clinton Ohlers recently met with WT Columnist, market analyst, and trading educator, Romulus, for an interview on navigating the financial markets. The Endowment for Press Freedom, referenced below, is part of the Free Press Foundation [FreePressFoundation.org]World Tribune:

Romulus, in Part II of this interview, we are continuing our discussion with how you avoided major market crashes like the Dotcom crash and 2008, and black swan events like 9/11 and Covid-19, and then even profited greatly, buying at the bottom of those panics.

One of the things that strikes me as remarkable about your career has been your repeated ability to spot, with rather unusual accuracy, the timeframe of the tops of the market. I saw you do this in September of ’21. You warned that we were looking at a possible topping in the market within a couple of weeks and within a couple of weeks to the day we saw a significant pullback, the first months.

Then, shortly after the highs in early January of 2022, you sent out a warning to everyone in Club Romulus to take retirement accounts to cash because the markets were topping out. A year and a half later, the markets are still down over 9% from that all time high.

Romulus:

That's just part of the history, the studying of the history. It comes back around to that.

WT:

But you’ve done this several times: days before 9/11, just before the Covid-19 crash, then getting back in at the lows of that crash, and even calling the top of Bitcoin, which we re-published in World Tribune at the start the Romulus Report.

Related: Ancient Roman predicted Bitcoin crash, June 28, 2021

Romulus:

Similar tools that helped identify the early ’22 top helped identify the Covid low, helped identify the the late ’07 early ’08 top, the same with the Dotcom crash.

With the Dotcom stuff I was in my local paper. It was a little bit after it started but the S&P 500 was only down about 7% down from its all time high. So, not any kind of crazy amount. I remember the interview. I said, "Everybody you need to get out of the market right now and right right quick."

For the next 18 months market proceeded to get completely and utterly destroyed, just destroyed for months and months and months.

With crypto two years ago, we called that top using the same tools.

It's just history. It’s history, applying it to current conditions and saying, “Look, mankind is not different.” We are driven by a handful of emotions. Fear and greed are two of those that are primary not only but two of the more present emotions in every human being. They have been with us forever from the beginning of time they will be with us forever.

And that's reflected in the trading behavior. It shows up in the trading behavior.

Grow Wealth, Not Risk. Trade alongside a 29-year market veteran

WT:

Tell us a little bit about how you saved investors money just days before 9/11. What happened there?

Romulus:

In August of 2001 the markets were demonstrating some behavior that I had never seen before. Very squirrelly behavior, not typical for late summer, and I thought, “Well this is very unusual.” While there is no one solution for unusual behavior, one thing you can do is just to get out. You can always come back. There will always be another trade. There will always be another investment opportunity, no matter how good or bad you think it is.

So, I just left. Now interest rates were higher back then, on average than they had been last five years. So, sitting in cash was paying about five and a half percent a year in a money market. All right, I'll sit there until something happens that shows me to do something else.

About 11 days later, the planes hit the towers.

After the investigations came around, and they started to uncover more of what was going on—this was years later—I learned that bin Laden and many other wealthy Saudi Arabians—many, many, Saudi Arabians many, many, many, many wealthy Saudis—connected to the Saudi family—including some of the top folks, I'm sure—were shorting the US stock market. Because they knew.

Now, I want you to think about what I just said. People who we call our allies could have called us and told us, but instead they decided to profit from it. Because they knew.

Club Romulus: Where knowledge plus action equals profitWT:

From what you are saying, even though this was happening in secret, they couldn't fully hide it from the markets.

Romulus:

Oh, I know. That's the beautiful thing about the markets. So the Chinese constantly try to intervene and manipulate the markets, currency markets, more so than anything else. It shows up. So even back in the day—I was reading a book a hundred years old now and the author of the book is talking about manipulation on a grand scale. Even the biggest wealthiest governments in the world can manipulate the markets for days or weeks, but over months, they can't. Not even a hundred years ago.

And even today, yes, the American government is wealthy. China has financial abilities that they've never had before. But even these governments cannot mimic the Federal Reserve. They cannot manipulate the markets for any type of intermediate or longer term time basis. No one and nothing can. The markets are too big.

So, I stayed out. The towers got hit. The markets got tanked. And then I was able to go in and buy bunches of stocks at very low prices after the markets reopened in late September, early October of 2001. And had a great run for the rest of the year.

The same thing happened with Covid-19. Shortly before that crash, politicians and others who knew what was coming started getting out of the markets. I saw unusual behavior and went to cash in February of ’20.I went back into the market in the last week of March, first week of April of ’20, just after the lows.

A neighbor asked me what I thought about the markets. I told him I was buying stocks again, and he looked at me like I was insane.

We know what happened since March of ’20.

Free Webinar: Victory Unit MasterclassWT:

The last year in the markets has been particularly good. However, you've been skeptical of this run up that we've seen. Tell us about that.

Romulus:

We've been taking shorter-term positions in these markets, both on the upside and the downside. We are maintaining flexibility, because a couple of issues showed up in the fall so that it looks like the bottom, at least for, now was put in. But that that bottom was not traditional. It was not historical by standards that have led to safer investing climates.

Even today, everyone's piling into the same handful of big tech stocks because they think there’s an AI revolution. And it might just be an AI revolution. It could very well be. But that doesn't mean it’s smart to go whole hog in just seven stocks, does it?

Does that sound like a Smart Investing Strategy for long term to put all your money in seven big stocks [pushing up the market] that are almost the most overvalued that they've been in all of history? Does that sound like a smart idea?

It doesn't to me. Not even close.

So, we have that flexibility. That's what the trading alerts are for.

WT:

In other words, it's basically seven stocks that are driving this huge run up.

Romulus:

And it's a dangerous environment like that. That's how the Dotcom crash and the financial crisis happened. There was only a handful of stocks holding up the rest of the market. If the market wants to broaden out, and started positively impacting the rest of the economy, the rest of the stock market, then fine, we can get on board, but not until we see the evidence of that.

Even the last two weeks we saw exactly what we're talking about. In mid to late May, finally there were smaller stocks trying to play catch up. But then just over two weeks ago, they got hammered again, the rug got pulled out. Just like that and they're back to desultory non-participation behavior.

Now even the bigger stocks that helped run the the rally for the course of the year, they're looking a little shaky. Will they pull back? I don't know, but we've got that covered.

This is what we do. If times call for that type of flexibility. Then we act in that manner. If times call for longer term buy and hold because you've got value, you've got the foundation for a strong multi year run, then we do. And if times call for gold, we get that.

We just follow the markets.

WT: Is there anything you want to add?

Romulus:

Yes. We're doing a free webinar here for WorldTribune.com and the Free Press Media Group readers next week. Please join us. We will show you awesome strategies and techniques that we've used for many, many years to help keep us straight, stay ahead of the markets and produce consistent returns regardless of market direction.

We're very excited about it. And I believe that over the next several months this partnership that we have slowly been building with the readers is going to blossom into something truly fantastic, to help keep all the readers financially on track to grow their portfolios, and to give them opportunities to take advantage of whatever the markets throw.

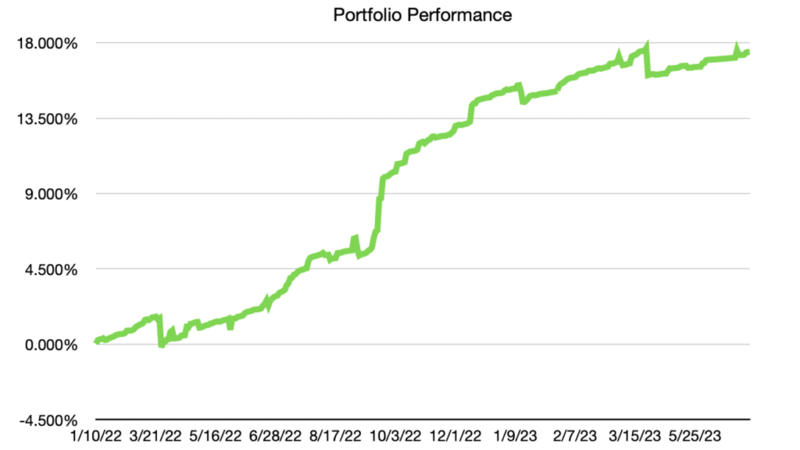

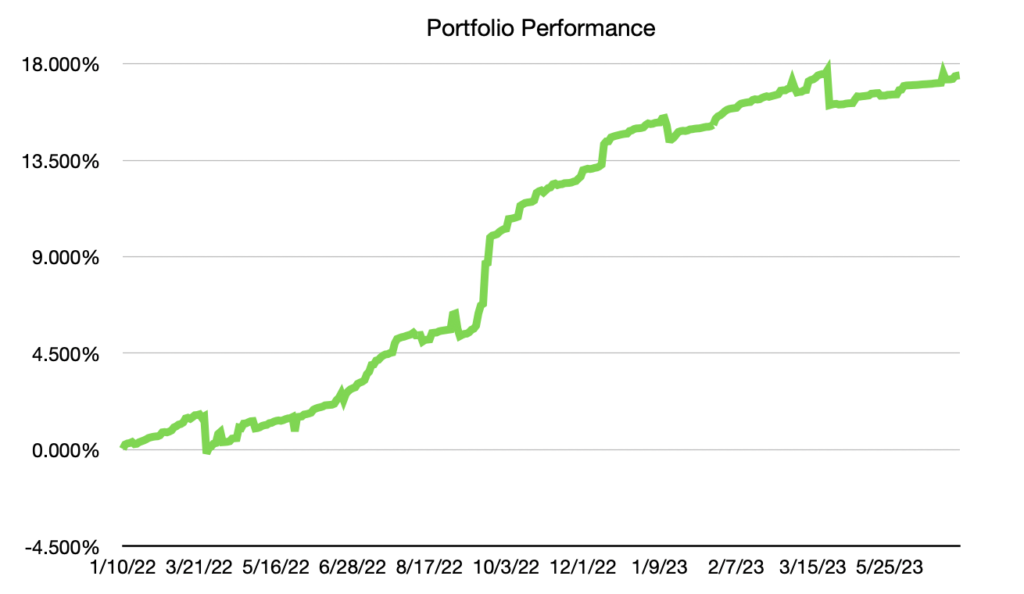

To learn about and sign up for the free webinar, go here: Victory Unit MasterclassClub Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%. The following graph approximates the potential growth of the Endowment for Press Freedom.

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%[/caption]

Club Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%[/caption]