MARKET Watch

by R. Clinton Ohlers WorldTribune's Investigative Editor Clinton Ohlers recently met with WT Columnist, market analyst, and trading educator, Romulus, for an interview on navigating the financial markets. The Endowment for Press Freedom, referenced below, is part of the Free Press Foundation [FreePressFoundation.org]WT:

Romulus, tell us about your personal history with the markets. You’ve been doing this a long time and over the years have had the remarkable timing to get out of the markets just before disaster, and then reenter at the very bottom of harrowing bear markets for the start of the next bull run.

Romulus:

Absolutely. I started on Wall Street almost 29 years ago in 1994. As a young pup out of college, I had an opportunity to join Wall Street with no idea about how this path was going to go for me. I remember when I started to my beginning class and the 10 of us, all new people to Wall Street. Early on in the training process, we sat around and talked about what we were going to be doing over the next few years why we were in this business to begin with.

Everybody said different things, like “Oh, in five years I want to retire and have a boat” or “I’m going to go buy a restaurant” or “I’m going to go up to the mountains,” or this, that, or the other thing. I was the only one who said, “I’ll be doing this.” And it's funny, years later that's exactly what I'm doing.

I started out as a broker and then went to a mid-level sized hedge fund. My responsibility there was to trade and invest, along with different customer and client interactions and communications. I did a lot of writing about the different markets, which you see the results of that today — I’m still writing a lot about the markets.

We managed money for rich people, but also for places like endowments, nonprofit endowments, we did a lot of that. I managed money for big retirement accounts, 401k plans for factories, you know, just good, all of the earth working Americans. I started doing that in the late 90s and kept working with that hedge fund all the way through 2012.

Grow Wealth, Not Risk. Trade alongside a 29-year market veteran

That was through the the end of the Dotcom peak, the crash and then the financial crisis run up—the housing build up and the mania that got going within the housing market and the mortgages—and the financial crisis and crash at the end of it. We were managing many, many millions of dollars for the very wealthy, but also for average working Americans.

These people to the person, man or woman, were so grateful that we were able to make them a little bit of money in this crash, when they knew everybody else had lost half or 60%, 70%, 80%, even 90% of their money. One of the messages I got from a lot of people was, “Hey, all my friends that aren't in these funds. They've got to work five or 10 years longer than they planned because they lost all their money.”

When they sold in ’12, I kind of did my own thing for a while, to help out rich people on the side, and spent time with my kids.

In 2020, right after COVID, I came back to the public space, started doing YouTube and teaching people how to trade in investment markets.

WT:

Part of that is the Romulus Report you publish with WorldTribune.com and Club Romulus, where you educate and and allow members to follow your daily trading. Tell us more about that.

Romulus:

We have a lot of ways that we get involved helping people in the markets. We put out daily reports in the morning. We produce videos. We get together in live sessions through zoom or other media channels and outlets. We record weekly sessions on Thursdays, called Thursday Night Live, to assess the state of the markets and where people can ask specific questions. We do special educational webinars on a regular basis. There's a lot of different ways that we're interacting and all this called "Club Romulus."

Club Romulus: Where knowledge plus action equals profitThe reason for the name is I'm a history nut. I majored in history in college. I didn't pursue finance, accounting, economics or business. I pursued history. It made such a big opportunity for me when I first came to Wall Street, because everybody else was doing things in a traditional financial metric way. I came at it from a historical perspective, and I still do.

Right before speaking to you, I was in a session with a lot of people, and we were talking about Ancient Rome and talking about mistakes with their own money. We talked about this a lot because if you want to get rich if you want to stay rich, if you want to grow your assets, if you want to help your family long term, you have to understand your interaction with money. You have to understand your hangups about it, the positives and negatives about it, and about you in relation with money.

And I was talking about Julius Caesar, something he figured out a long time ago. He was a great military tactician, a phenomenal general, brilliant military mind. But he was also brilliant period, just anything in life. He figured out that to help the Roman economy, let's move the money around faster. He figured that out before anyone else did. It's the velocity of money and it's one of the biggest helpful factors.

Studying these things helped me a tremendous amount over the past couple of decades of my involvement with the markets with trading with investing and staying ahead.

One of the consequences of something like COVID or the.com crash or the financial crisis, or anytime there's a slight negative ripple to the global economy, is what do the government's do? Print money. And then we know what happens, we get inflation and other constant negative consequences from that. It will be devastating at some point.

People don't stop and think. Is this an original idea? No.

The first paper money came out with the Mongol Empire, because China was was great at printing paper. They were great at paper manufacturing and printing different things with it. They said, "Wait a minute, we can put money out here, and if we want to, just run the press." It basically led to the end of the Mongol Empire — the free printing of money.

If you think this government that we're with today is going to be able to have their cake and eat it, to serve it to you and serve themselves, to infinity with no negative consequences, that's silly. History says otherwise. Just because it hasn't caught up to us, yet, doesn't mean that it won't.

So this studying of the markets, the behavior of the markets historically, versus what's going on today, has always served me incredibly well. We don't take all those ideas and bring them into day-to-day trading every single day, but they are foundational to all that we do, all the time.

The critical foundation, it’s history. It’s history of trading. It’s history of money. It's history of investors and people interacting with that money, and interacting with those markets on a daily basis.

That's what keeps us ahead. So I love teaching this.

As a result, one of the hallmarks of what we do is that it doesn't matter if the markets go up or down. If they want to go up, we make money. If they want to go down, we make money. We provide consistent returns, regardless of market direction. And that gives me the ability to have peace and calm knowing that I'll be able to grow my own portfolio and take care of my family, no matter what happens.

Free Webinar: Victory Unit MasterclassWT:

Part and parcel with this, and with the analysis you provide for the Endowment for Press Freedom, is that you send out messages, for educational purposes, whenever you take a trade in your in your two main portfolios, ACTA and Aquilus. Your members can then follow along those trades in their own accounts, building wealth and mitigating risk alongside you. Tell us about that.

Romulus:

We do something very unique around here. Many years ago, before texting was commonplace, I figured out a way to help communicate with the few people that I was working with, via messaging. As that grew with more people and trade ideas, I was texting those to them. I was the first person out there I know of to text trade alerts. No one had done it before.

And so we send our Centurions — the people that are part of club Romulus — a text and it says, “I’m buying this stock,” with the symbol. Importantly, it says how much of my own money, what percentage of the portfolio, I'm putting into that. It isn’t just “hey, I'm buying,” or “Hey, this is a good trade idea.” That's what everybody else does. So it's the stock, the price and the amount of money that goes in. It's all one sentence.

All that people have to do is open their trading app — whether that's Thinkorswim, TD Ameritrade, Fidelity, Charles Schwab, Interactive Brokers, whatever it is — they open their trading app at the end or beginning of the trading day, and they're done. It takes 45 seconds. And you see this a few times a week. That's it.

WT:

In Part II of this interview, we will continue our discussion with how you avoided major market crashes like the Dotcom crash and 2008, as well as black swan events like 9/11 and Covid-19, and then even profited greatly, buying at the bottom of those panics.

For now, is there anything you want to add?

Romulus :

Yes. We're going to be doing a free webinar here for WorldTribune.com and the Free Press Media Group readers in just under two weeks. Everybody please join us. We're going to show you awesome strategies and techniques that we've used for many, many years to help keep us straight, stay ahead of the markets and produce consistent returns regardless of market direction.

We're very excited about it. And I believe that over the next several months this partnership that we have slowly been building between us and the readers is going to blossom into something truly fantastic, to help keep all the readers financially on track to grow their portfolios, and to give them opportunities to take advantage of whatever the markets throw.

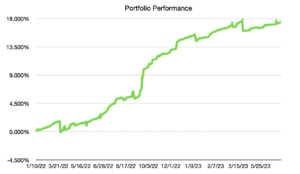

To learn about and sign up for the free webinar, go here: Victory Unit MasterclassClub Romulus portfolio performance from January 2022 to July, 2023: +17.46%. S&P500 during the same period: -7.70%. The following graph approximates the potential growth of the Endowment for Press Freedom. [caption id="attachment_124733" align="alignnone" width="748"]