Support the Free Press

MARKET Watch

by Romulus at Backpack TraderImpressions are everything.

Part of that is built on reputation, which comes from experience, longevity and results. Impressions play a powerful role in the stock market and that takes us to sentiment.I am going to ask some questions about a few big corporations. Pay attention to your immediate, gut reaction response.

What is your overall impression of Apple? How would you feel if you worked there? Do you think Apple would make a good long-term investment now? (Let’s define a "good long-term investment" as a stock that can deliver returns slightly higher or even better than the general stock market for the next 10 years).

Grow Wealth, Not Risk. Trade alongside a 27 year hedge fund veteran

Ask yourself the same questions for Disney, Google and Amazon. The impression for most people of these firms is one of invincibility. They would have an amazing amount of pride if they worked for these companies and most investors believe all four stocks would make good long-term investments.

Rewind and go through the questions again, this time for Westinghouse, Union Carbide, US Steel and Eastman Kodak. The average impression is the exact opposite for these firms. Westinghouse and Union Carbide aren’t around anymore, but people don’t feel immense pride working for US Steel or Kodak, not these days. Rational people don’t consider US Steel a good long-term investment, and no one believes Kodak is a smart play.

Even after the recent 28% pullback in Apple’s stock, it is still the most valuable company on earth. The institutional investing crowd maintains a strong belief that Apple is a great long-term investment, one of the best they can find. Amazon just split their stock and Google is doing the same next week, both in order to jockey for a spot in the venerable Dow Jones Industrial Average Index. Disney and Apple are currently in the Dow, which is one reason they have this impression of invincibility.

40 years ago, Westinghouse, Union Carbide, US Steel and Kodak were all members of the Dow Jones Industrial Average. The sentiment surrounding these companies was much like that for Disney and Apple today. I know it is hard to imagine, but people used to think Kodak was one of the greatest corporations in U.S. history. Today, Elon Musk can buy the entire company for what he keeps in his coffee jar.

Club Romulus: Where knowledge plus action equals profitYou can see the point I am making. Nothing grows to heaven. Things always change. US Steel and Kodak are not going back to what they were before, but Apple and Amazon will not be invincible titans 10 years from now.

One of the favored companies mentioned above is in the middle of an existential dilemma right now.

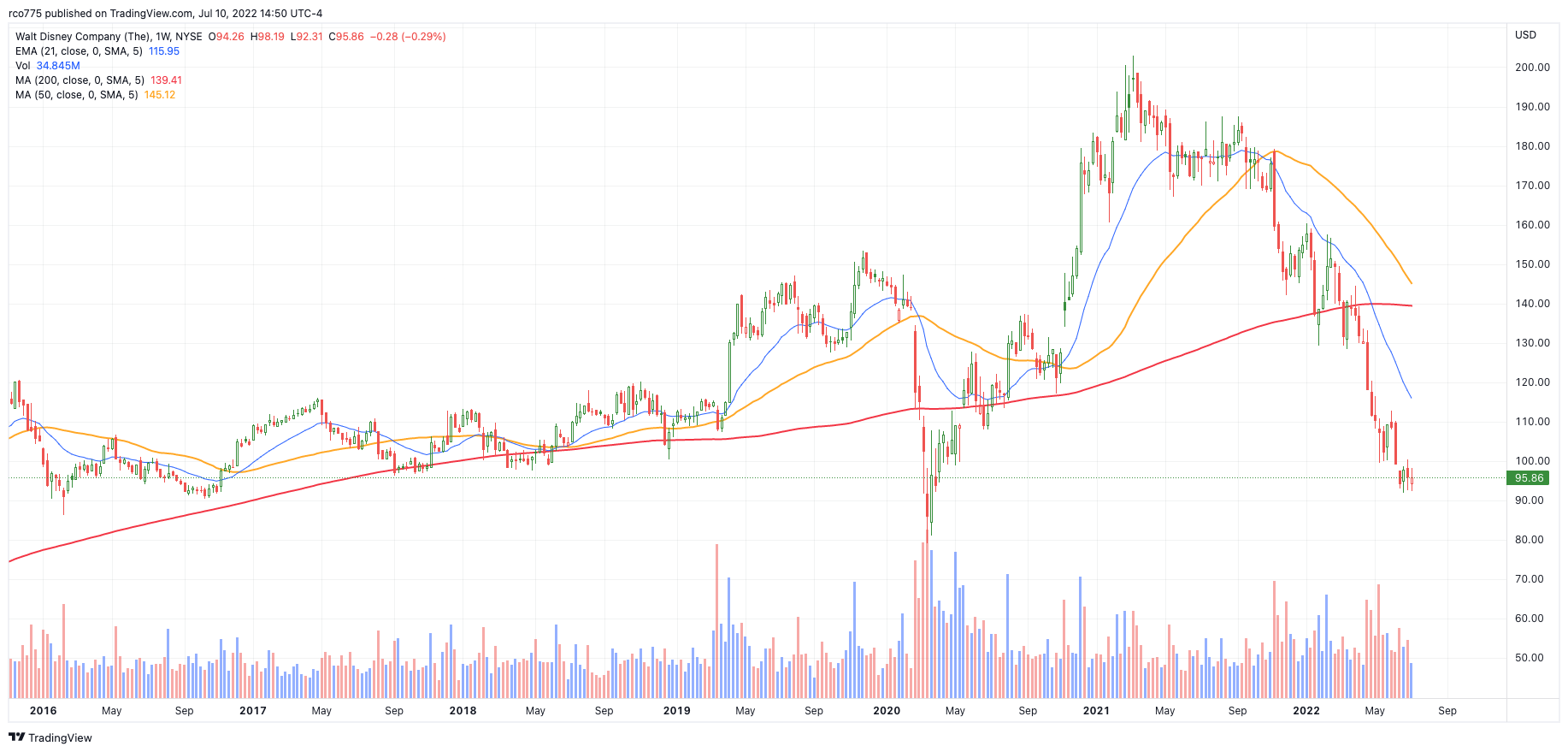

The Walt Disney Corporation has been a mainstay of corporate America for almost 90 years. The inventory of old classics like Snow White and Mickey Mouse is worth billions. Their theme parks and media outlets are valuable assets that should provide good cash flow far into the future. Disney stock has pulled back with the rest of the market recently (although DIS is down 50% versus a 21% fall for the S&P), but everything "should be fine" longer-term for the house the mouse built.

Everything should be fine, but it isn’t.

There is a systemic problem within this company that is starting to look like the beginning of the end.

One of my unrevealed secrets is an analytical method that can show long-term sustainable strength or weakness in stocks that accurately translates to the future direction of the company itself.

Grow Wealth, Not Risk. Trade alongside a 27 year hedge fund veteran

Back in April of 2021 I told my trading group that by the end of that summer, every street corner in America was going to have Peloton bikes out with their garbage. I’ve never tried a Peloton (although as a former collegiate cyclist, I know how boring it is training indoors!), but the stock showed secular weakness. PTON is down 92% from when I said that, and it is down 94% from its all-time high! The company is a total train wreck.

DIS is not going to fall 94% from its all-time high. That would bring it down to about $15 a share. But the stock is experiencing serious distribution now. The kind that leads to months and years of under-performance. The kind that precedes an eventual booting from the Dow Jones Industrial Average. This is not a short or intermediate situation. Disney falling out of the Dow is a 10 or even 20-year journey. It will take a long time to reverse decades of “good feelings” about this firm. The stock will go through rallies and corrections, but it will remain in a downtrend for years to come. There is a crack in the foundation of Mickey’s house, and you know foundation cracks are tough to repair.

If you doubt what I am saying, keep in mind that General Electric was an original member of the Dow Jones back in 1986. The company could do no wrong 20 years ago. The employee pride was enormous, and the bullish opinion of institutional investors was unshakable.

GE was kicked out of the Dow 4 years ago, June 26th, 2018.

Monthly GE chart with an all-time high of $465, now trading for $63, down 86% from that high.

Remember:

Wealth, like Rome, cannot be built in a day. But, like Rome, it can be lost in a day. Watch for future announcements from Romulus about profitable market moves, important indicators, and major market swings. For trading education, mentoring, or to beat the markets with Romulus' trading group, contact romulusteaches@yahoo.com.

About the author: In his real-life existence, Romulus started on Wall Street in 1994 and traded for a hedge fund for 13 years. Since 1994, he has called every major market top ahead of time and profited from them, including the break of the Dot-com bubble in 2000, the market crashes of 2008 and 2009, and the Covid crash of 2020. Since 2020 he has been working with investors and traders to actively manage their portfolios by growing wealth, not risk, as a teacher and mentor working with Backpack Trader, a stock trading educational company.

Action . . . . Intelligence . . . . Publish