MARKET Watch

by RomulusThe children's tale of the Three Little Pigs imparts an important moral value, one relevant at any age when it comes to trading the markets.

The difference between the eldest pig and the his two younger brothers was that he was wise, patient, and willing to put more time into his survival. He built his house out of bricks and waited for the storm. But that took significant time, planning, and effort.

When the Big Bad Wolf couldn’t blow this house down the house, the wise pig even had a contingency plan in the event of apparent victory but an undeterred wolf. When the wolf tried sneaking down the chimney, but the wise pig had a fire waiting for him. Rather than being caught offguard basking in the glory of the strength of his house, the wise pig recognized a smaller structural weakness, fortified it, and that led to the ultimate victory — a victory where pigs dined on wolf, rather than the other way around!

While it is not discussed in the fable, the first two pigs were motivated by laziness or greed when building their houses out of straw and wood. This is easier and cheaper than constructing a home out of bricks. They very nearly paid the ultimate price for succumbing to these temptations.

In the current market conditions that we find ourselves, there are a lot of similarities between market and those pigs, along with a few stark differences. The most important point, though, is the lurking risk of the wolf and whether he will (or even can) strike.

Grow Wealth, Not Risk. Trade alongside a 29-year market veteran

Almost nine months after the most recent stock market bottom, a sense of complacency has crept in among the institutional investing class. Most (not all) are convinced that the bottom is in, and that therefore it is a good idea to load up on big technology stocks and let them ride. They have built their houses out of the straw and wood of complacency and hopefulness.A further problem for these investors, like the two younger pigs, is that they can’t move fast. If their house is blown down, it will be too late to react safely.

Free Webinar: Victory Unit Masterclass—Manage your own portfolio like a pro!

In the early stage of a new bull market, the advance is sustained by a steady broadening of participation. Leadership changes, but there is an “all-in” sense to the action. That historical behavior of new bull markets stands in stark contrast to today’s situation.

We all know that a few large technology stocks have done very well since last October, but what isn’t getting discussed in polite company is the lagging performance of almost everything else in the world. From the Dow Jones and small caps to bonds and foreign stocks, the last several months show flat to negative returns.

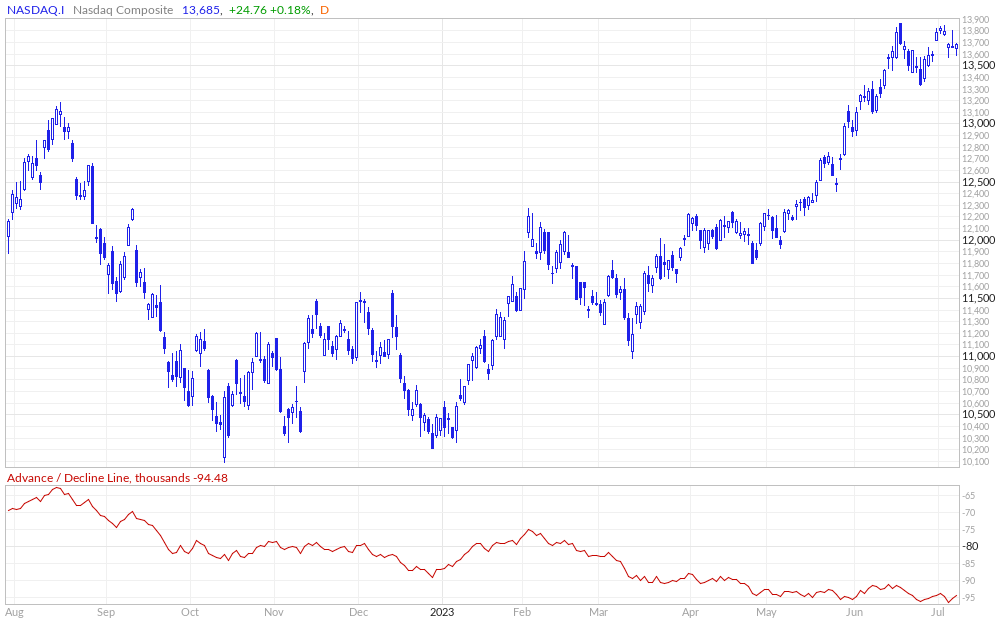

Did you know that the Nasdaq stock index closed at a 14-month high a week ago, but the advance/decline line hit a multi-year low? That means that the number of stocks going up, versus the number going lower is at an all time high.

Talk about a bearish (or wolfish) divergence!

Image courtesy of MarketInOut.com MarketInOut.com

Image courtesy of MarketInOut.com MarketInOut.comClub Romulus: Where knowledge plus action equals profit

The pigs had the advantage of knowing the wolf was out there (he told them what he was going to do before he did it!). We don’t have the same benefit. The S&P 500 and Nasdaq indexes have been carried by a few big stocks for several months. It is possible, but not probable, that the rally can broaden out. If this happens, a more sustainable and safer advance can be expected. Until and unless that happens, this market is sitting in a house of straw and wood.

In future reports I will be noting price zones that could stop any further selling (the bulk of the current rally peaked, so far, on June 16th). These zones need to be watched carefully to see if the wolf is warming up his lungs.

At this time (for nimble traders and investors like us) it is not necessary to bunker down in the brick house and bolt the doors. It is wise, however, not to venture too far from the hearth. Leave the front door open for now, but have the fire ready to go.

The third pig was careful when others threw caution to the wind. Let’s learn the lesson from this popular fable and stay prepared.

Remember:

Wealth, like Rome, cannot be built in a day. But, like Rome, it can be lost in a day.Watch for future announcements from Romulus about profitable market moves, important indicators, and major market swings. For trading education, mentoring, or to beat the markets with Romulus’ trading group, contact romulusteaches@yahoo.com.

To learn about and sign up for Romulus' free webinar, click on the sidebar ad, or go here: Victory Unit Masterclass

About the author: In his real-life existence, Romulus started on Wall Street in 1994 and traded for a hedge fund for 13 years. Since 1994, he has called every major market top ahead of time and profited from them, including the break of the Dot-com bubble in 2000, the market crashes of 2008 and 2009, and the Covid crash of 2020. Since 2020 he has been working with investors and traders to actively manage their portfolios by growing wealth, not risk, as a teacher and mentor.